Single Certification 2018 – Template, Instructions and Deadlines

The deadline for submitting to the Internal Revenue Service the ordinary form of the 2018 Single Certification attesting to employee and assimilated income, self-employment income, commissions and certain miscellaneous income paid in 2017 is now due.

By Wednesday, March 7, 2018, the 2018 Single Tax Certificate (formerly the CUD) must be submitted electronically by tax withholding agents to the Internal Revenue Service. The data will feed into pre-filed tax returns, available to taxpayers starting next April 16. For Single Certifications not containing information useful for pre-filing, the deadline for transmission to the Internal Revenue Service is the same as for the submission of 770 forms, i.e., by Oct. 31, 2018. It is then to be delivered to employees by next March 31 (April 2 for this year) and the self-employed for compensation subject to withholding tax.

The CU was introduced into our tax system in 2015, replacing the old CUD form for employees and assimilated workers and the old compensation certification for self-employed persons. Let’s take a detailed look at what the CU is, what it is for, who it affects, how it is transmitted and the 2018 deadlines.

Unified Certification 2018: what it’s all about

The purpose of the CU is to certify employee and assimilated income , self-employment income, commissions and miscellaneous income as well as consideration from short lease contracts. That of short leases is the most important novelty contained in CU 2018.

For the 2017 tax year, tax withholding agents must electronically submit to the Internal Revenue Service by March 7 certifications for employee income, self-employment income and miscellaneous income, to be issued to the recipient by March 31.

The 2018 Single Certification is divided into “ordinary” and “synthetic.”

The Single Certification must be issued to the recipient of the amounts, using the “synthetic” form by March 31, while the transmission to the Internal Revenue Service, using the “ordinary” form must be made by March 7, electronically. The “ordinary” form, unlike the “synthetic” form, does not carry the ballot for the allocation of 2, 5 and 8 per thousand of Irpef. Please note that the “summary” must be delivered to the employee by April 2, 2018, as the ordinary deadline of March 31 falls on a Saturday this year.

The ordinary telematic flow to be sent to the Agency consists of:

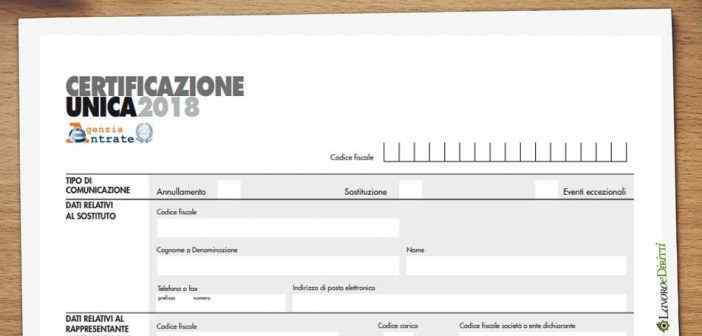

- Cover page in which information on the type of communication, data on the substitute, data on the representative signing the communication, the signature of the communication, and the commitment to telematic submission are given;

- Schedule CT in which information regarding the electronic receipt of data on Form 730-4s made available by the Internal Revenue Service is reported;

- Unified Certification 2018 in which the following are reported:

- tax and social security data related to employee, assimilated and tax assistance certifications;

- to self-employment, commission and miscellaneous income certifications;

- as well as tax data on income certifications related to short leases.

Unified Certification 2018: those required to submit it

Individuals who in 2017 are required to send the telematic flow by March 7, 2018:

- Have paid sums or values subject to withholding tax

- Have paid social security and welfare contributions and/or insurance premiums due to Inail

CU 2018 must also be submitted by individuals who have paid sums and values for which withholding taxes are not required. This is in the case where they are subject to contributions due to INPS (previously obliged to submit Form O1/M), such as foreign companies employing Italian workers abroad who are insured in Italy.

INAIL insurance position holders also report data on insured personnel with CU by filling in the appropriate box provided for the Institute. All administrations that are tax substitutes in any case enrolled in the managements merged into INPS gestione Dipendenti Pubblici, as well as entities with personnel optionally enrolled in INPS gestione Dipendenti Pubblici, are required to fill out the Single Certification.

The declaration must also be completed by tax withholding agents with employees enrolled in ENPDEP insurance management only.

Unified Certification 2018: deadline and submission methods

The deadline for making the telematic submission, to the Internal Revenue Service, of the data related to the unique certifications is March 7, 2018.

Instead, the deadline is Oct. 31 for certifications containing only exempt or nonreportable income through the pre-filed tax return.

The tax withholding agent who provided tax assistance in the year 2018 must electronically transmit the Mod. 730/2018 returns and corresponding settlement statements (Mod. 730-3) to the Internal Revenue Service by July 7.

The stream must be submitted only electronically and can be transmitted:

- directly by the person required to make the communication;

- Through a licensed intermediary.

Submission of the Single Certification may take place:

- Directly by the person required to make the communication: tneutors must use the Fisconline or Entratel telematic services

- Through a licensed intermediary.

Software is available on the Internal Revenue Service website:

- Compilation – which allows you to enter data and prepare the file

- of control-which reports any anomalies or inconsistencies found between the content of the declaration (and its annexes) and the indications provided by the technical specifications and the control circular.

In order to consider the match closed, it will be necessary to wait for the next receipt certifying that the transaction is correct and that the communication has been submitted, which is also available in the “Receipts” section of the Agency’s website. In any case, the receipt notice can be requested without any time limit (either by the taxpayer or the intermediary) from any Revenue Office. Then, in relation to the verification of the timeliness of communications submitted electronically, communications submitted within the prescribed time limit but discarded by the telematics service are considered timely, provided they are re-transmitted within five days after the date contained in the communication stating the reason for rejection.